Sam Chambers October 7, 2022

Yesterday saw the European Union adopt an eighth package of sanctions against Russia for its aggression against Ukraine, including targeting the nation’s class society. However, trading volumes in dry bulk and oil show the Russian export machine is working around the clock to deliver ever more cargoes of energy.

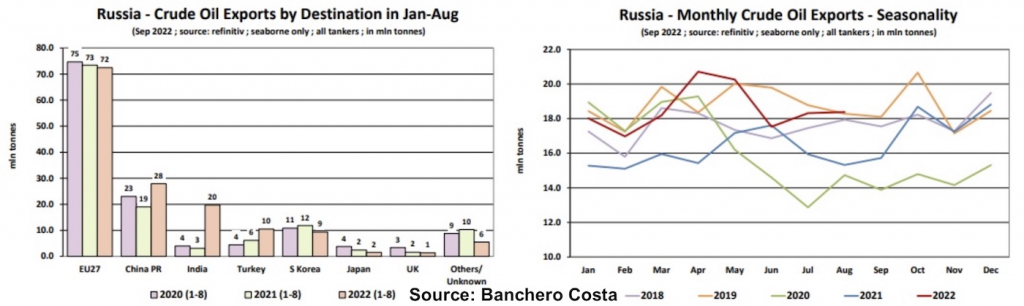

According to Banchero Costa, Russia is now back exporting crude oil at pre-covid levels, its 11.1% of global shipments so far this year cementing its second place in the world oil rankings behind Saudi Arabia.

In the first eight months of 2022, Russia managed to ship 148.4m tonnes of crude oil, excluding domestic cabotage, up +16.1% year-on-year with India seen upping its imports the most.

Most of the increase in exports this year have been from the Baltic Sea and Black Sea, whilst exports from Russia’s Far East ports have actually shrunk.

About 68% of crude oil shipped from Russian ports so far in 2022 was loaded in aframaxes, 31% in suezmaxes, and none on VLCCs, according to Banchero Costa, with plenty of cargoes then moved ship-to-ship onto larger ships for Asian destinations once out of Russian waters.

What’s more, as the December 5 European ban on Russian oil imports nears, there has been a notable uptick in tanker voyages from Russia since July, according to new data from Sea/, which notes top destinations so far this year are the Netherlands, Turkey, China, Italy and India.

Preliminary information from brokers BRS suggests that September was a record month for tanker sales and purchase transactions with 61 units changing hands for further trading. This consisted of a significant volume of vintage tonnage, including seven VLCCs, five suezmaxes and eight aframaxes, all of which would make good candidates to eventually haul Russian crude.

“The thought of sanctioned cargoes has kept even the older ladies off the beach with vessels even out of class finding new homes at well above scrap,” a new report from brokers Hartland pointed out.

Sea/ has also been tracking Russian coal export volumes and notes that in June, July and August they were higher than in 2021 with South Korea, Japan, India, Turkey and China to the fore.

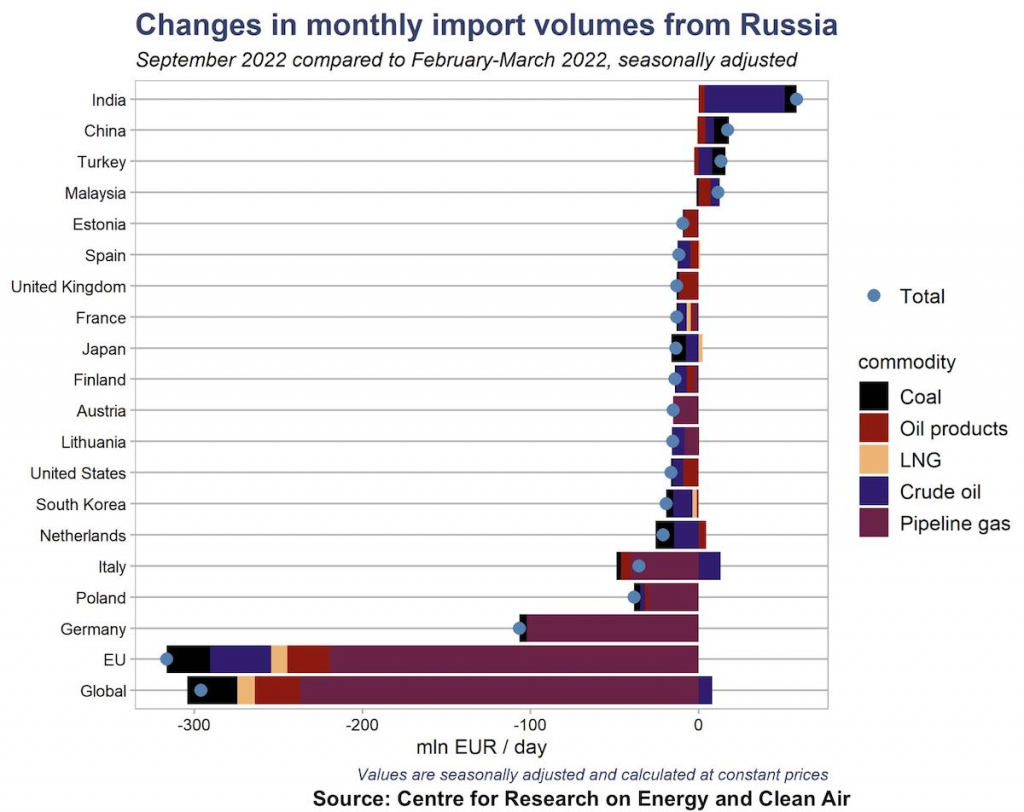

A new report from the Centre for Research on Energy and Clean Air shows how European Union nations have spent more than $100bn on Russian fossil fuels since the since the February 24 invasion of Ukraine.

Real-time estimates of fossil fuel sales from Russia to the EU show that the 27-member bloc continues to import crude oil, oil products, LNG and pipeline gas worth around $255m per day (see chart below).

Yesterday saw the European Union adopt an eighth package of sanctions against Russia, introducing new EU import bans worth nearly $7bn to curb Russia’s revenues, as well as export restrictions.

The package also marks the beginning of the implementation within the EU of the G7 agreement on Russian oil exports. While the EU’s ban on importing Russian seaborne crude oil fully remains, a new price cap, once implemented, will allow European operators to undertake and support the transport of Russian oil to third countries, provided its price remains under a pre-set cap, something the EU said yesterday would help to further reduce Russia’s revenues, while keeping global energy markets stable through continued supplies.

Also of note in yesterdays latest sanctions news from Brussels is a ban on all transactions with the Russian Maritime Register, one of the world’s largest classification societies.