Two liners seek listings in Hong Kong

Sam Chambers November 9, 2022

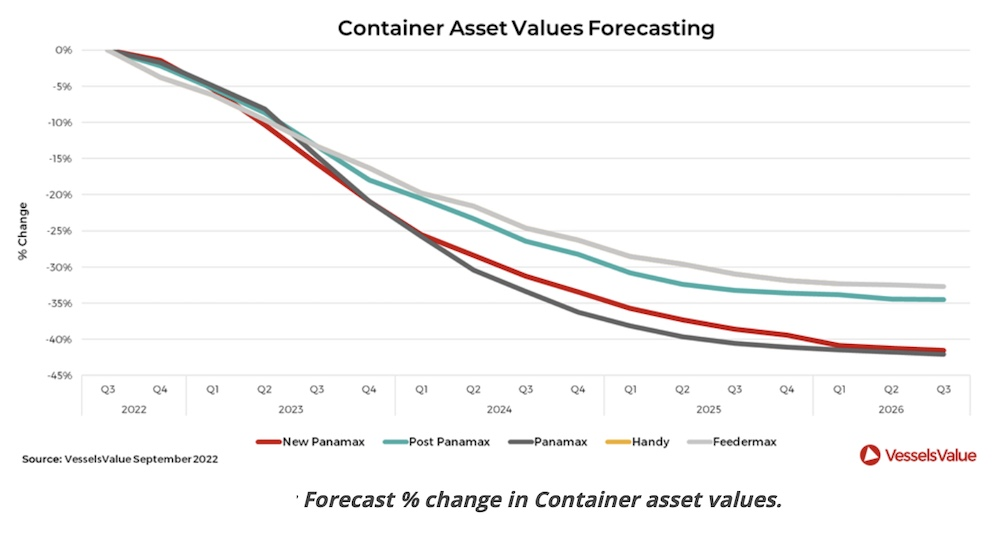

The container party might be showing signs of fizzling out, but that is not stopping a number of Asian liners seeking listings.

TS Group, the parent company of TS Lines, has filed an application for a Hong Kong stock exchange listing, as has Chinese freight forwarder LC Logistics, parent of BAL Container Line.

TS Lines has Taiwanese origins, but is incorporated in Hong Kong. It currently operates 49 ships of 106,203 teu, making it the 19th largest operator worldwide, according to Alphaliner.

BAL Container Line, meanwhile, has roots in Qingdao. It has four ships in its fleet at the moment but is due to expand significantly in 2025 when it takes delivery of two 14,700 teu ships from Jiangnan Shipyard.

To the north of Hong Kong, another Chinese stock exchange is also gearing up to welcome a shipping line to its ranks. Ningbo Ocean Shipping Co (NBOSCO), Ningbo-Zhoushan Port Group’s shipping subsidiary, will list on the Shanghai Stock Exchange shortly, using cash raised to expand its fleet.

NBOSCO’s owned fleet today comprises 28 boxships, six multipurpose vessels, seven bulk carriers and one general cargo ship, as well as 30 chartered containerships.